STAR CRITICAL ILLNESS MULTIPAY INSURANCE POLICY

STAR HEALTH INSURANCE CRITICAL ILLNESS MULTIPAY INSURANCE POLICY

Star Critical Illness Multiply Insurance Policy

Unique Identification No.: SHAHLIP22140V012122

STAR CRITICAL ILLNESS MULTIPAY INSURANCE POLICY KEY FEATURE'S:

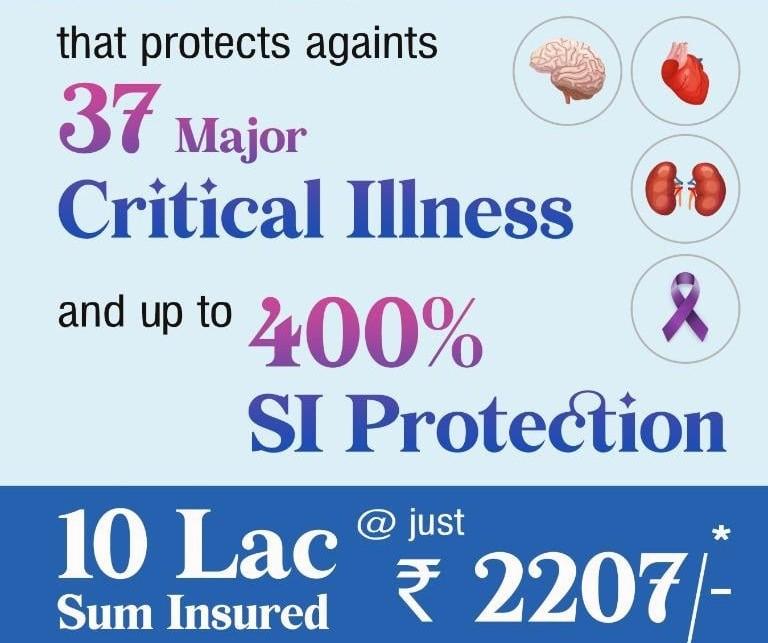

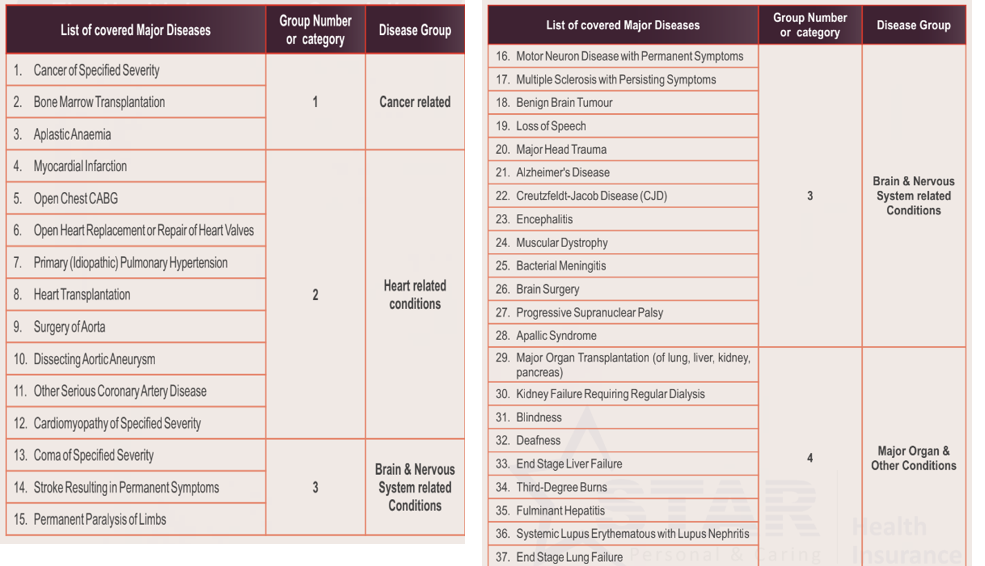

Financial confidence is very crucial while you are fighting back a critical illness. Hence, we are presenting Star Critical Illness Multiply Insurance Policy, a critical illness policy providing lumpsum benefit on diagnosis of Critical illnesses related to Cancer, Heart, Brain & Nervous System and Major Organ & Other Conditions as listed in the 4 group categories. The distinct features and benefits offered by the policy make it, the right protection to overcome the financial impact caused by any critical illness.

Policy Term: 1 year / 2 years / 3 years: For policies with term more than one year, the Sum Insured is for each year, without any carry over benefit.

Type of Policy: Individual

Eligibility: Persons aged between 18 years to 65 years can avail this Insurance. Proposer should be aged 18 years and above.

Sum Insured Options: Minimum Rs. 5,00,000/- to Maximum Rs.25,00,000/- (in multiples of Rs.1,00,000/-)

● For Earning persons:12 times of yearly income for 18 – 35 yrs age and 10 times of yearly income for above 35 yrs age. The maximum sum insured cannot exceed Rs.25 lacs.

● For Non-Earning persons: Maximum up to 15 lacs. Non-earning sum insured cannot be more than the sum insured for the primary member.

Pre acceptance medical screening: No medical examination is required where the person proposed for insurance is up to and inclusive of 50 yrs of age. Medical Examination is required where the person proposed for insurance is above 50 years of age and for those who declare

adverse medical history in the proposal form.

Instalment Facility available: Premium can be paid Quarterly, Half-yearly. Premium can also be paid Annual, Biennial (Once in 2 years) and Triennial (Once in 3 years). For instalment mode of payment, the loading applied for each Instalment option is provided below

Quarterly: 3%

Half Yearly: 2%

Note: This loading will be applied on annual premium.

Benefits Covered :

I. If during the period stated in the Policy Schedule the insured person shall be diagnosed with any Major Disease/s specified in the table given here under, the Company will pay to the Insured Person a lump-sum not exceeding the sum insured.

Special Conditions:

i. Major Disease experienced by the Insured is the first incidence of that Major Disease; and

ii. The first diagnosis of the covered major disease / condition should have been experienced by the insured only after 90 days of commencement of cover under the policy.

iii. The insured person should have survived up to 15 days from the date of diagnosis of such Major disease; and

iv. Incidence of the Disease specified in the policy must be confirmed by a registered medical practitioner appointed by the Company and must be supported by clinical, radiological, histological, pathological, histo-pathological and laboratory evidence acceptable to the Company.

v. Only one claim is admissible under each group

vi. If the insured claims for multiple major diseases at the same time, then the Company's liability will be for only one Group.

vii. Upon payment of lump-sum on occurrence of any Major Disease, the insurance will continue to provide coverage under the policy subject to the following:

a. Cover shall be given for a second, third and fourth occurrences of covered Major diseases under other Group and maximum of 4 such occurrences are covered over a life time of the Insured.

b. Maximum One lump-sum (up to 100% of the Sum Insured) can be paid from each Group of covered Major Diseases and total payout over a life time of the Insured cannot exceed 400% of the Sum Insured.

c. Waiting period of 12 - months shall apply between the occurrence of each condition (i.e between the first and second condition or between the second and third condition or between the third and fourth condition)

d. The policy being renewed and the second or third or fourth event occurs during the renewed policy period.

e. Insured person is eligible for renewal if at least one category is left where there has been no claim made.

f. Maximum One Claim only is payable in a Policy Year.

Renewal of policy: The policy shall ordinarily be renewable except on grounds of fraud, misrepresentation by the Insured Person.

i. The Company shall endeavor to give notice for renewal. However, the Company is not under obligation to give any notice for renewal.

ii. Renewal shall not be denied on the ground that the insured person had made a claim or claims in the preceding policy years.

iii. Request for renewal along with requisite premium shall be received by the Company before the end of the policy period.

iv. At the end of the policy period, the policy shall terminate and can be renewed within the Grace Period of 30 days to maintain continuity of benefits without break in policy. Coverage is not available during the grace period.

v. No loading shall apply on renewals based on individual claims experience.

Note: Policy can be renewed if at least one category is left where there has been no claim made.

Claims Procedure:

· Claim form duly completed and signed

· Medical Certificate confirming the diagnosis / treatment of Major Disease from the treating medical practitioner in letter head.

· All Diagnostic test results / Imaging confirming positive existence of Major Disease

· Discharge summary / in case papers / complete treatment records (wherever applicable)

· Treating doctor's certificate regarding the duration & etiologic of the Major Disease in letter head.

· Any other document specific to the treatment / illness.

Possibility of Revision of Terms of the Policy including the Premium Rates:

The Company, with prior approval of lRDAl, may revise or modify the terms of the policy including the premium rates. The insured person shall be notified three months before the changes are affected. Enhancement of Sum insured: Sum insured once opted cannot be enhanced even on renewal.

The Company: Star Health and Allied Insurance Co. Ltd., commenced its operations in 2006 as India's first Standalone Health Insurance provider. As an exclusive Health Insurer, the Company is providing sterling services in Health, Personal Accident & Overseas Travel Insurance and is committed to setting international benchmarks in service and personal caring.

Star Advantages

· No Third-Party Administrator, direct in-house claims settlement

· Faster and hassle – free claim settlement

· Cashless hospitalization

Buy this insurance: Please contact me & visit my website www.adepusrinivas.in

Tax Benefits: Payment of premium by any mode other than cash for this insurance is eligible

for relief under Section 80D of the Income Tax Act 1961.

IRDAI IS NOT INVOLVED IN ACTIVITIES LIKE SELLING INSURANCE POLICIES,

ANNOUNCING BONUS OR INVESTMENT OF PREMIUMS. PUBLIC RECEIVING

SUCH PHONE CALLS ARE REQUESTED TO LODGE A POLICE COMPLAINT

For More Details Contact me now……..

ADEPU SRINIVAS

Senior Health Insurance Advisor

Srnvs.adepu@gmail.com

Contact: 70952 13366

SRINIVAS ADEPU

Leave a comment

Your email address will not be published. Required fields are marked *